Author: Will Webster

Subject Matter Expert: Ethan Wing

What is a pricing strategy?

In the simplest terms, a pricing strategy is your game plan for setting the right price for your product or service. Sometimes known as a pricing method, finding the right one is not just a case of slapping on a price tag; it’s a calculated move.

The strategy you choose directly influences how your target audience perceives your brand and how much revenue you can make. Understanding which strategy aligns with your business goals and market is crucial.

Free eBook: How to price products for maximum profitability

The three main pricing strategies

There is no such thing as the best pricing strategy, but there are three major types that dominate the market: cost-based pricing, competitor-based pricing and value-based pricing.

Cost-based pricing: This strategy involves setting the price by adding a markup to the cost of producing or acquiring the product.

Competitor-based pricing: In this approach, you set your price based on what your competitors are charging for similar products or services. Also known as a competitive pricing strategy.

Value-based pricing: This strategy sets the price based on the perceived value to your target customers, and it’s often the go-to choice for companies if they have the flexibility to choose, as it tends to maximize profits.

Cost-based pricing in action: Walmart

Cost-based pricing is all about understanding your expenses and then marking up the product price for a profit. It’s straightforward but effective, especially when competing in markets that are highly price-sensitive.

Walmart, the retail giant, is a master at this. It negotiates with suppliers to get rock-bottom prices and then passes the savings on to the consumer. This allows them to promise low prices every day, reinforcing their position as the go-to store for budget shoppers.

Competitor-based pricing in action: Samsung

When using competitor-based pricing, your prices are dictated by what your rivals are charging. This strategy is often used in industries where products and services are similar, and price becomes a decisive factor for consumers.

Samsung keeps a close eye on Apple and other tech players to gauge competitor pricing. This allows them to stay competitive, often offering high-quality phones that are slightly cheaper than Apple, attracting budget-conscious tech enthusiasts.

Value-based pricing in action: Tesla

Value-based pricing is about setting a price according to how much your customer believes what you’re selling is worth. This is often the preferred strategy for businesses that have the flexibility to set their prices because it allows for higher profit margins.

Tesla’s electric cars aren’t just modes of transportation; they’re a statement about sustainability and innovation. Tesla can charge premium prices because people are willing to pay for not just a car, but a step towards a more sustainable future and the prestige that comes with it.

Defining cost, gross margin and markup

Underlying all pricing strategies is the goal to grow revenue while keeping healthy profitability. To do this, you need a strong grasp of costs, margins and markups. Here’s a quick recap:

Cost of goods sold

This is the amount you spend to get your product or service to market. It includes things like manufacturing and materials, cost of labor to produce tangible goods, payment to your suppliers and any loss or wastage that happens along the way.

For pricing purposes, the cost of goods sold (COGS) doesn’t include general overheads like heating, lighting, rent etc. or auxiliary business functions like marketing and sales, which are categorized as operating costs.

Gross margin

The margin (aka profit margin) is the part of the price you have left over once the costs have been taken out. In the context of pricing strategy, it’s vital because it gives you the flexibility to adjust pricing without taking a hit on profitability.

There are different types of margins:

- Operating margin: This takes into account your operating costs, like salaries and rent, and gives you an idea of the business’s operational efficiency

- EBITDA margin: EBITDA – or Earnings Before Interest, Taxes, Depreciation and Amortization – considers a broader range of costs, but still excludes interest, taxes, depreciation and amortization

- Net margin: This is literally the bottom line. It’s what you have left after all expenses, taxes and additional income streams are accounted for

Markup

Markup is what you add on to the cost of producing or providing your products and services to arrive at the price your customer pays. In a pricing strategy context, markup is critical for covering not just the COGS but also operating expenses and desired profit margins.

The trick is to set the markup so that the final price appeals to consumers while still providing a healthy margin.

Why it’s crucial to get the price right

The right price is a matter of balance. If you price your product too high, your customer won’t buy it. If you price it too low, they’ll buy it, but your margins will suffer.

Pricing correctly involves understanding consumer psychology. Many will do this based on intuition, but a data-based approach is what will yield the best results.

Regardless of the approach, the fundamental question is this: What will a high or low price mean to my customer?

High prices can actually enhance the perceived value of something, especially if it’s a luxury purchase associated with status and aspiration; while low prices are more affordable, your customer may see a cheap price tag and perceive the product as lower quality. Pricing too low could even reduce customer trust and even degrade your brand value.

It’s not just about you and your customer either. In today’s saturated markets, there’s a third factor in the mix – your competition. When setting prices, it’s important to benchmark against what strategies your competitors are using and what they’re charging for comparable products.

The prices in your market niche will provide a psychological anchor point for customers in terms of what a fair price is, so you should aim to keep in range of your competitors. You may charge a little less or a little more, taking into account aspects of your products, brands and services that will justify price differences to your customer (such as enhanced product features, sustainable manufacturing, excellent service, no-frills store experience and so on).

Understanding price sensitivity through conjoint analysis

Knowing your customer’s willingness to pay is vital for your business’s long-term success. And it’s just as much about avoiding the wrong price as finding the right one – Incorrect pricing can lead to missed revenue opportunities or even alienate your customer base.

This is where pricing research is essential. Here’s what it can bring to your product and business:

- Profit maximization: Accurate pricing allows you to capture the most revenue from each sale, enhancing profitability

- Customer loyalty: Well-calibrated pricing fosters trust and satisfaction among your customer base, encouraging repeat business

- Competitive positioning: A keen understanding of customer price sensitivity can provide a strategic advantage, allowing you to compete effectively

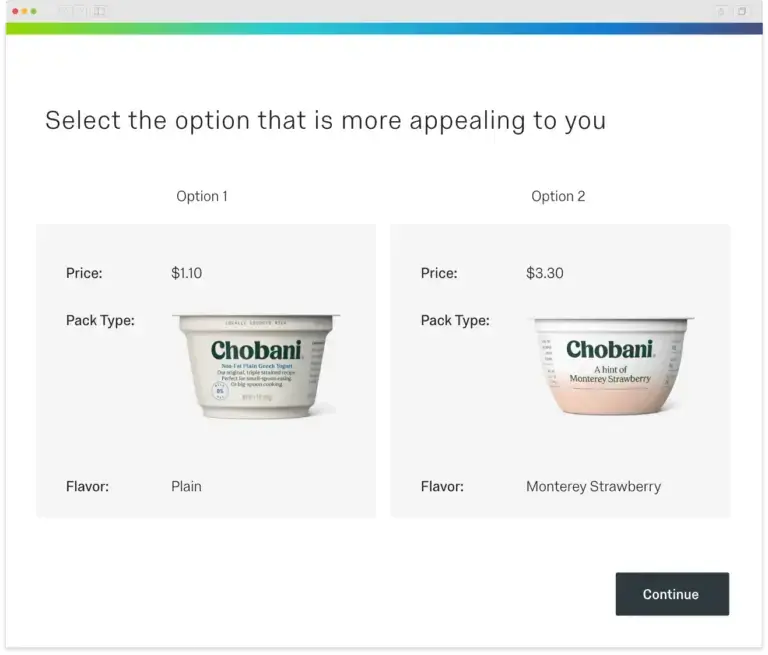

Conjoint analysis is the gold standard in pricing research, and a key feature of Qualtrics® Strategic Research. Also known as Discrete Choice Modeling, it offers a more nuanced, data-backed understanding of customer preferences than more dated research methods like Van Westendorp’s Pricing Index and Gabor-Grainger.

By automatically configuring the product features and price points that will resonate most with your customer base, conjoint analysis sets the stage for impactful business decisions by removing the guesswork.

It explores how different features influence pricing tolerance, allowing for a more tailored and effective pricing strategy. It’s a method that’s been widely recognized for its depth and accuracy, making it the standout choice for companies serious about optimizing their pricing.

Here’s why it stands out:

- Pre-launch precision: Before you even launch, conjoint analysis helps you discover the ideal product configuration and price – drastically increasing your chances of success

- Focused development: It highlights the areas that are most critical for your product’s success, allowing you to allocate resources more efficiently

- Dynamic simulation: The method includes intuitive simulators that show you the real-time impact of any changes to product features or pricing – even benchmarking against competitors to gauge your market position

Free eBook: How to price products for maximum profitability

5 pricing strategies to know about, with real-world examples

Beyond cost-based pricing, competitor-based pricing and value-based pricing, there are many different pricing strategies available.

Here are some of the more common pricing strategies, alongside fairly famous examples of them being applied in the real world.

Penetration pricing

A new business enters the market with goods priced well below what its competitors are charging. Customer interest is drawn by the low price and good value on offer. Once the brand is established and has acquired a strong customer base, it begins to bring its prices in line with what’s typical for the industry.

Adopting this strategy involves risk. It means taking a hit on profits during the initial phase, which not all new businesses will be able to survive. However, it’s a powerful way to capture market share from well-established competitors and can help develop a company culture of focus and efficiency.

This pricing strategy is often seen in the airline industry, where new entrants face steep competition from well-established players. Virgin America used penetration pricing when it strategically entered the US market with lower-than-average fares in the early 2000s, and successfully captured consumer attention and market share.

As the brand gained loyalty and recognition, it gradually adjusted their pricing to match industry standards, all while maintaining a value proposition that kept customers coming back.

Premium pricing

If an item costs more, a customer will perceive it as having more value. That’s the logic behind premium pricing. A business using premium pricing intentionally charges more than its competitors, trading on a brand that’s all about quality and prestige.

To make this strategy work, brand value and product quality must be carefully built and maintained. The upside is that markup and margin will be higher than typical for the product category.

In the world of consultancy, McKinsey stands out as a prime example of effective premium pricing. Known for its high-quality services and elite reputation, McKinsey can charge significantly more than other firms and still maintain a strong client base. Clients are willing to pay a premium for the perceived added value, expertise and the prestigious association with the McKinsey brand. As a result, the firm enjoys higher margins, further reinforcing its premium positioning in the market.

Price skimming

Taking its name from the world of dairy goods, price skimming is the strategy of charging a high price when a product is new on the market.

The “cream” of the customer base are early adopters eager to be the first to access the product and willing to pay a price premium. Over time as the product is less novel and appealing, the price may be reduced to appeal to successive levels of the customer base who have less appetite and higher price sensitivity.

This approach has the obvious advantage of bringing in more revenue early in the product’s lifecycle, and maximizing profit by taking advantage of every level of price tolerance within the customer base. It can also help support perceptions of premium quality and make the product more desirable.

On the downside, it’s well-recognized by customers and many people are likely to wait it out rather than pay more early on. Its success also depends on the nature of the product – aspirational tech companies, for example, get a lot of success from this strategy, but for many other types of business it would fall flat. Why? Because successfully leveraging price skimming relies heavily on a brand image that’s synonymous with innovation and/or exclusivity – something relatively few benefit from

Apple’s iPhone is a textbook example of price skimming in action. New iPhone models are introduced at a high price point, targeting tech enthusiasts and brand loyalists willing to pay a premium for the latest features. It’s only when the next iPhone model is about to be released that Apple typically reduces the price of the existing model.

This strategy not only successfully maximizes early-stage revenue for Apple, but also positions the iPhone as a premium product throughout its lifecycle – as we’ve seen since the dawn of the first version.

Bundle pricing

As much about product packaging as pricing, bundling is the practice of grouping several items together under a single price tag.

Bundle pricing can be a useful psychological nudge technique to motivate customers, especially if you let them know that the collective value of the items in the bundle is greater than the bundle price.

It can increase appeal in terms of utility and ease, especially where the items are complementary in function or form (think shampoo and conditioner sets, or burger and fries meals). Bundling is also used to help with inventory management – you can bundle together a less-popular item with a top seller in order to help move it off the shelves.

By grouping a main, side and a drink together with the added allure of a toy, the McDonald’s Happy Meal is a quintessential example of effective bundle pricing. It expertly appeals not only to children who want the toy, but also to parents looking for an easy, all-in-one meal option for their kids.

Loss-leading

Like penetration pricing, loss-leading uses very low prices to grab customer attention. This might be in the form of a special offer, or single product line which is sold at a heavily reduced margin. The business recoups the loss on other products with healthier margins which customers discover after they have been drawn in by the loss-leading item.

Note that loss-leading has a more extreme cousin, known as predatory pricing. This is where a company aggressively underprices a product in order to defeat its competition. Predatory pricing is illegal in many regions. In the US, predatory pricing is often gauged using the Areeda-Turner test.

Grocery stores often employ a form of loss-leading with free samples or tasters – often positioned strategically near the priced version of the same thing, or complementary products. For example, a store may offer free cheese samples near its deli counter, or free chips next to salsa and guacamole. The idea is to entice customers with the free or low-cost item, only to drive sales of more profitable items that the customer is now more likely to purchase.

How to choose a pricing strategy

Choosing how much to charge and how to structure your pricing is a big decision, and one that deserves some consideration and research.

Be clear on costs

Before you think about price, you need a clear understanding of the cost of your goods or services. Make sure you include every element of product development, manufacture and supply, and the delivery of services (including things like equipment and uniform costs if applicable). Add a percentage to cover losses and waste too.

Benchmark against competitors

Carry out competitor analysis to learn what comparable businesses are charging in your market. As well as looking at current prices, explore historical price patterns to see if they’ve employed techniques like penetration pricing or loss leading in the past.

Think about your timeline

If you’re considering a time-bound pricing strategy such as price-skimming or penetration pricing, you need to know how long you will do it for and what the impact will be on your profits over that timeframe. Is an initial loss sustainable? If price skimming, can you predict when to take down your prices on a schedule in order to get the best results?

Do pricing research

As we’ve already explained – simply because it’s so important – pricing research is a fundamental step before any pricing strategy can ever be put in place. Conjoint analysis is the gold standard in pricing research, providing a data-backed understanding of customer preferences.

Pricing strategies vs. pricing models

Pricing strategies are often mentioned in the same breath as pricing models. So are they the same thing? Not quite.

A pricing strategy is the way you set the price.

A pricing model is a kind of price format – it’s part of the way you package and present your goods and services to the customer. In SaaS contexts, a business’s pricing model is often known as “packaging”.

An example of different pricing models is subscription vs. one-off payments. Take streaming media – whichever pricing model is used, the product is the same (films, TV shows or music). But with subscription pricing, you’re selling access to a large library of titles on a time-bound basis, rather than charging a one-off cost to own or rent an individual recording.

As a general rule, a pricing strategy is internal to your business, and a pricing model is external, aimed towards your customer. You won’t find many pricing strategies in marketing communications, but you’ll find plenty of pricing models.

7 pricing models to consider

Choosing the right pricing model is a critical decision for any business. From freemium to sliding scale, each model comes with its own set of advantages and challenges.

Here we’ve broken down seven popular pricing strategies, along with their pros and cons.

Freemium

Your basic product or service is free, or ad-supported. Users can opt to pay more for premium features or a better/ad-free experience.

An example of a business using a freemium model is Dropbox, which offers a small amount of storage with a free account, and charges users if and when they want more space for their files.

Pros: Freemium models often see large consumer adoption due to the free entry point, allowing users to test out basic features without commitment.

Cons: The challenge lies in convincing those free users to convert to a paid plan. Without a highly desirable feature only available in the paid tier, conversion rates can be low.

Flat-rate subscriptions

Users pay a set cost on a regular basis, for example $9.99 for unlimited music streaming from a library of media that you own.

Spotify currently uses this model for its main product (although it also offers a concession rate for students and a bulk price family plan).

Pros: Flat-rate subscriptions are easy to understand and provide predictability for customers, making budgeting simpler.

Cons: The one-size-fits-all approach may not cater to specific customer needs. Businesses risk leaving value on the table as the cost-to-serve can significantly vary among different customer segments.

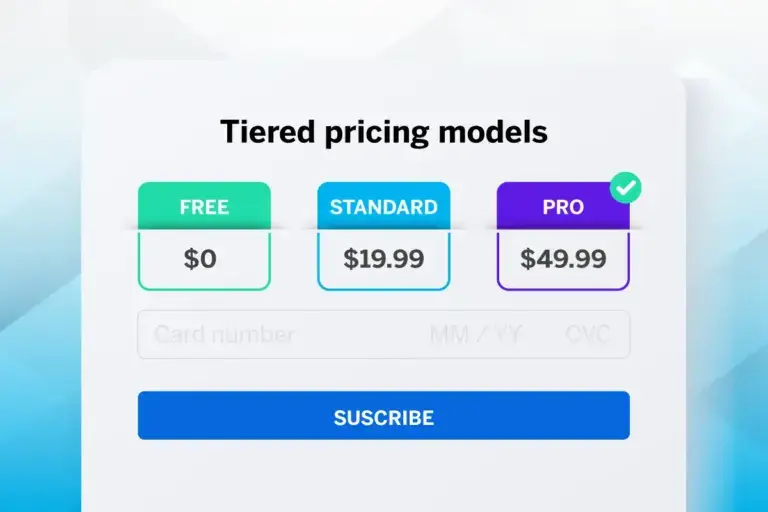

Tiered subscriptions

As with flat-rate subscriptions, the user pays a regular fee, but they can choose how much to pay depending on their expected usage levels or desired features. This is a very common model in the SaaS world, and is often combined with freemium pricing (where the lowest tier is free).

This model is sometimes used as a form of price anchoring – where the lowest and highest tiers help to position the medium tier as the best value.

Pros: Tiered plans can cater to a wide range of customer needs and budgets, allowing for greater market penetration and scalability.

Cons: The range of options can overwhelm customers, leading to choice paralysis. It also complicates the pricing structure and can complicate forecasting.

Pay as you feel/pay what you want

The customer can pay as much or as little as they want to. This approach is often used for charity sales or fundraising.

The band Radiohead used this approach when they released their In Rainbows album in 2007.

Pros: This model can generate significant goodwill and attract a broad customer base due to the perceived fairness and freedom in pricing.

Cons: The business risks financial instability as revenue becomes unpredictable and is essentially left up to customer discretion.

Bulk pricing

Price goes down as the volume of goods or services goes up. This is common in B2B sales and wholesale transactions.

Pros: Encourages larger orders by offering discounts on high-volume purchases, increasing the average transaction value and potentially reducing per-unit costs.

Cons: Customers may be deterred if they don’t require large quantities, and those who do buy in bulk risk overstocking issues.

Market pricing

Price fluctuates according to the market, rising and falling in line with supply and demand. Gas pricing is the most common example of this.

Pros: Market pricing adapts to supply and demand, enabling dynamic adjustments for maximum profitability.

Cons: Frequent or extreme price fluctuations can frustrate customers and erode trust, potentially leading to churn.

Sliding scale pricing

Price varies according to the means of the customer. This might be used in settings like healthcare, where client need is considered from an ethical point of view as well as a financial one.

This is similar to pay what you feel pricing, but there is a recommended or standard price published, and prices outside that are negotiated on a case by case basis between business and customer.

Pros: By offering pricing based on a customer’s ability to pay, businesses can increase accessibility and target a more diverse market.

Cons: Establishing a fair and manageable sliding scale can be complex. It also has the potential to alienate customers who fall just outside of discounted tiers but still seek value.

Ready to dive deeper into pricing strategies?

If you found this guide helpful and want to take your pricing strategy to the next level, we’ve got just the resource for you. Download our comprehensive eBook, “How to Price Products for Maximum Profitability”, to get even more insights, case studies, and actionable tips.

Whether you’re a startup looking to break into the market or an established business aiming to optimize profitability, this ebook has something for everyone.

Free eBook: How to price products for maximum profitability