Author: Will Webster

Subject Matter Expert: Trevor Evans

Why identify and monitor competitors?

Every business has to compete within its market. And markets are finite – you’re constantly either competing over new market share with competitors, trying to convert their customer base, or protecting your own customer base from them.

This is why every smart business should clearly understand and document competitor positioning.

Keeping an eye on your competitive landscape means discovering:

- What they, your competitors, are offering

- How much they are charging

- What their value proposition is

- Who their customers are

- How they are marketing their product or service

- What new products are appearing in the market

A strong approach to competitive analysis will empower your business to see where the exploitable weaknesses are among your competitors, what threats they pose to your business, and in some cases, opportunities for partnership and collaboration.

Start learning more about your competitors with the Competitive Benchmarking Study

Who are my competitors?

Understanding your competition goes far beyond identifying businesses selling similar products or services. It’s about recognizing who out there is impacting your market presence, customer base and brand perception – and businesses do this in various ways.

First is the most obvious: through a product or service overlap. Understanding key competitors in your niche is crucial because it will help you gauge market demand, pricing strategies, and position your offerings effectively to stand out among similar choices.

There will also be businesses you’re competing with for online presence on social media platforms and in search engine results for the same keywords. These online competitors can be split into two groups that often overlap: paid and organic competitors. Conversely, there are businesses you may compete with in the physical world through events and networking as you vie for attention from the same people.

Connected to this is competition in recruitment. Especially now in the age of Big Tech and the ever-growing tech start-up ecosystem, businesses find themselves aggressively competing for the same talent.

Companies that share the same supplier and partner relationships could also be considered your competitors. In an ideal world you may never feel any impact from them, but if your provider faces supply issues and can only cater to one business, you most definitely will.

Categorizing your competitors

If you want to build a comprehensive understanding of your competitive landscape, it’s a very useful exercise to categorize your competitors. Here are the buckets you should be putting them into.

Direct competitors

Direct competitors are the brands that first come to mind when you think about your competition – your top competitors. They’re in your sector or local competitors in your neighborhood, marketing products and services that do the same like-for-like job as yours.

You know they’re your direct competitors because your target audience is the same as theirs. For example, a garden center’s direct competitors are all the other garden centers in the local area.

Indirect competitors

Indirect competitors are trickier to spot. They address the same customer needs as your business does, but they do it in a different way.

Your target audience will overlap with theirs but won’t be an exact match – an indirect competitor to the garden center might be a supermarket. Garden supplies aren’t its core business, but it may offer cheap plants. Using its economies of scale, the supermarket can undercut the garden center’s prices and offer convenience to shoppers who pick up trays of bedding plants alongside their weekly grocery shop.

Substitute competitors

Substitute competitors don’t sell the same products but compete for consumer spending

For example, bars, cafés, restaurants, delis and supermarkets all compete for lunchtime trade on a main street.

New entrants

New entrants are new competitors who enter a market offering the same products or services. Depending on the barriers to entry, new entrants will find it easy or hard to establish themselves.

How to find competitors

Identifying and understanding your competitors can feel like a daunting task. However, it’s one that’s made a lot simpler when you break it down into its three core areas.

Keep these three areas in focus and you’ll be well on your way to mapping out your competitive landscape.

Market research

Start with the basics – market research. This is your first step to understanding the landscape you’re operating in, whether you want to explore a global market or find local competitors. Industry reports, trade media, events and conferences – these are your best friends if you’re on a journey to identify competitors.

Good market research will help you spot not only the direct competitors who offer the same products or services as you do, but also indirect competitors who cater to your target audience’s needs in different ways.

Customer feedback

Never underestimate the power of customer insights.

Your existing customers can be a goldmine of information when it comes to identifying competitors; only they can tell you why they chose your product or service over others – or vice versa.

Adopting a customer-centric approach not only helps in identifying competitors but also in understanding your market position.

Online tools and social media

This could fall into market research, but really the digital world is so big and so influential that it’s its own beast.

Using search engines to look up keywords related to your business can unveil many competitors; social media can quickly show you what’s trending and what your target audience is talking about; tools like SEMrush and Ahrefs can take your research a notch higher, helping to identify who your paid search competitors are, for example, and offering deeper insights into their online strategies.

The Internet is the breeding ground for competitive advantage – the challenge is that anyone can leverage it to find gaps in a market and develop unique marketing strategies. What separates the most effective from the rest, however, is the toolkit they have access to.

Tools for identifying competitors

If competitor research can be a tad overwhelming, so can the volume of tools out there. But not all competitor research tools are created equal.

Here are some of the best options out there, from entry level to sophisticated.

Tools for getting started

Google Trends: A great starting point for beginners, Google Trends allows you to see what’s trending in your industry. It’s simple to use and helps you understand the popularity of specific search terms over time, which can give insights into market interests and potential competitors.

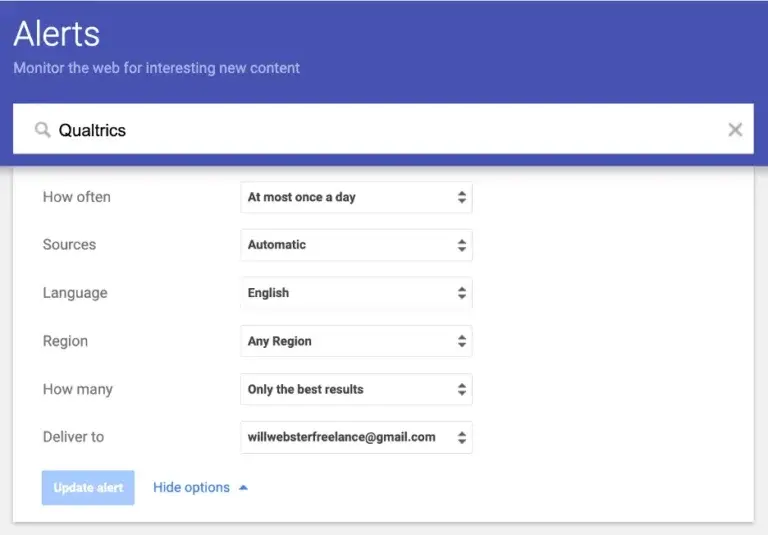

Google Alerts: A straightforward, no-cost way to stay connected with the competitive landscape. Setting up alerts for the names of other businesses, industry keywords or specific market trends means you’ll receive real-time email notifications whenever these terms are mentioned online.

SimilarWeb: With a paid version that would easily find itself in the below section, SimilarWeb also offers a collection of free tools that give a glimpse into your competitors’ website traffic and engagement metrics. Also available as a convenient browser extension, SimilarWeb provides enough data to get a sense of how well competitors are doing in terms of online presence and audience reach.

BuiltWith: This tool provides detailed information on the technology stack used by competitors’ websites – offering unique insights into their digital strategy and capabilities.

Tools for staying up-to-date

SEMrush: A step up in sophistication, SEMrush is an all-encompassing tool for SEO, paid traffic and market research. It helps you keep an eye on your competitors’ SEO strategies, keywords they are ranking for and their advertising tactics.

Ahrefs: A powerful tool for SEO analysis, Ahrefs is perfect for tracking competitors’ backlinks, keywords and content strategies. Its in-depth analytics help stay updated on competitors’ online presence and content effectiveness.

BuzzSumo: Also excellent for content analysis, BuzzSumo lets you track what content is trending in your industry. This indirectly helps in identifying what strategies competitors are using to engage their audience and how effective they are.

Tools for building and maintaining competitive intelligence

Kompyte: Aimed at real-time tracking of competitors’ online strategies, Kompyte is particularly useful for businesses that need ongoing, detailed analysis of their competitors’ moves in the digital space.

Klue: Klue is a platform that specializes in collecting, curating and distributing competitive intelligence. It’s invaluable for businesses looking to build a comprehensive understanding of their competitors’ strategies and market dynamics.

Brandwatch: Brandwatch excels in social media listening and analytics, offering deep insights into what’s being said about your competitors online. Ideal for businesses ready to invest in detailed social media analysis, Brandwatch provides a comprehensive view of the competitive landscape in the digital world.

Leveraging AI in competitor research

The current Artificial Intelligence boom is revolutionizing the competitor research landscape, transforming the depth, speed and efficiency with which businesses can gather competitive intelligence.

Generative AI tools like ChatGPT can be employed to create comprehensive competitor profiles, summarize industry reports and even suggest potential competitive strategies. Their ability to process and synthesize large volumes of information quickly makes it an invaluable resource.

Search engines like Google are now using AI to facilitate more efficient and targeted online research from natural language queries. And research tools, like Klue and Kompyte, are also harnessing the power of AI – using algorithms to track competitor activities, analyze market trends and provide actionable insights.

The integration of AI in everyday competitor research is not only now saving time but also ensures a more nuanced understanding of the competitive landscape.

As AI technology continues to evolve, its role in strategic business analysis will only become even more significant – offering companies a cutting-edge advantage in understanding and outmaneuvering their competitors.

Why it’s not all about the competition

While yes, understanding and positioning against competitors is crucial, it’s vital to remember that an excessive focus on competition can be counterproductive – often leading to a reactive business strategy that stifles creativity and innovation.

Renowned thinker Edward de Bono once said, “Companies that solely focus on competition will die. Those that focus on value creation will thrive.” This sentiment is more relevant today than ever.

In the modern business landscape, the emphasis on value creation has gone up several notches. Companies are now recognizing that their competitive advantage doesn’t solely lie in outperforming rivals, but in how they create and deliver unique value to their customers.

Value creation involves innovating, understanding customer needs deeply and offering solutions that not only solve problems but also enhance the customer experience. It’s about building a brand that resonates with customers on levels beyond just the features or pricing of a product or service.

While competitor analysis is a valuable tool in your arsenal, it should not overshadow the primary goal of your business: to create and deliver value.

Standout with competitive benchmarking

Deepen your understanding of where you stand in the market with our Competitive Benchmarking Study.

This study can deliver crucial insights into your brand’s performance against competitors, helping you identify strengths, areas for improvement and strategies to outpace the competition. It will help you:

- Leverage real-time comparative data against competitors.

- Identify unique brand strengths and improvement areas.

- Build strategies that are aligned with consumer needs.

Start learning more about your competitors with the Competitive Benchmarking Study