Often, researchers can find themselves in a number of difficult tight spots at work:

- Having a low budget to conduct research or budgetary constraints

- No need or desire for a representative sample to move forward with your research

- You don’t have access to the full target population for a representative sample

- A requirement to act quickly within a limited timeframe to meet a deadline

- Managers want to get a ‘sense’ of the opinions, habits, and values of their target audience before embarking on full-scale research

So, what do you do when these situations occur? Convenience sampling might be the best solution to help you get the results you need, in the time and budget you have.

Discover how to minimise sampling error with this complete guide.

What is convenience sampling?

Convenience sampling is the most common type of non-probability sampling, which focuses on gaining information from participants (the sample) who are ‘convenient’ for the researcher to access.

This sample method doesn’t require a random selection of participants based on any set of criteria (like demographic factors) — instead, researchers can subjectively select people at random, who are happy to be approached and become part of the research.

This means that you can find your sample anywhere — for example, people in a mall, on the street, in the workplace or in an online community — at any time. They are all opportunities to carry out research. (Due to this, this type of sampling method is also known as availability sampling, grab sampling, opportunity sampling, and accidental sampling.)

It is best used for testing as part of hypothesis generation, getting a ‘sense’ of opinions or as an initial pilot before further research.

Don’t mistake this for random sampling, because of how people can be stopped at random by the researcher. It is also unlike probability sampling, as participants are not randomly selected and do not have an equal chance of being selected in the sample.

How does convenience sampling work?

If you’re curious on how to get started, it’s one of the simplest methods:

- Think about what you aim to achieve in your research

- Confirm who would be the target population that would help your research

- Think about where you could go to speak to these people in a convenient way (e.g. would they be found in-person at a precise location, or online in a forum or group?).

- Prepare your questions into a survey that asks questions for your research

- Ask for willing people for your convenience sample and give your survey to them

That’s it. No need to explore the full population (if you have one) and divide them into sub-sections, get in touch with the sample ahead of time or find a representative sample.

Places you could use include your workplace, a mall, a high street, an online interest group, a club, etc. The list is endless.

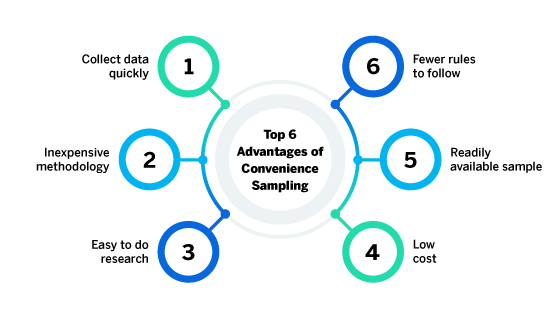

Advantages of convenience sampling

There are several reasons why convenience sampling is so frequently used and attractive to researchers:

- Data collection is easier and anyone can do the research: You don’t need to be trained or have a lot of experience to do data collection for convenience sampling. By creating a survey that helps you collect information in quantitative ways, can allow you to quickly analyse trends. In addition, having a smaller sample will save time going through lots of raw data.

- Quick and low cost: Being able to conduct your research at speed and with very little cost involved can make this sampling method preferable to investing in full-scale research projects.

- Great for initial research: If you’re not sure about the thoughts, beliefs, and values of your target audience, or if you just want to do a small-scale initial survey, convenience sampling is a great way to go about it.

- Pilots can be quicker: Using convenience sampling for pilot data collection can give you the information your managers need to make decisions quickly with the right data.

- Fewer rules make easily accessible participants: Since the sample is made up of present and willing people that are convenient to approach, the process becomes faster and convenient overall for the research carrying it out.

- Ease of future participants: If more participants are needed at a later date to create multiple samples in future research (to provide more information results over time or to try and replicate results), this is easier as there are no criteria to assess for.

- Participants can be geographically spread out: You can have a sample from people all over the globe with an online survey that is positioned to where your target participants would visit online.

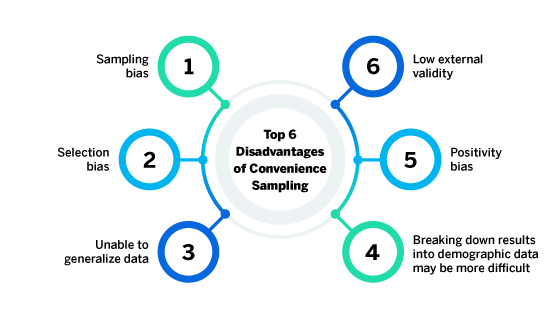

Disadvantages of convenience sampling

As with any sampling method, there will be some drawbacks:

- Sampling bias: As the sample is based on people who are willing at the time and place that the researcher is present, you won’t be gaining a range of people each time you’re collecting data. In addition, the research subjectively chooses people to ask if they would like to be a part of the research, so this could influence the final sample as well.

- Selection bias: Many researchers might point out that having a convenience sample may end up excluding demographic subsets from the results. Also, the volunteer nature of the participation means that people who are inclined to know about the subject or pro-topic may appear more represented in the data.

- Unable to generalise data: As the sample will be unrepresentative of the total population, you will find it hard to generalise about the population as a whole.

- Low external validity: If you do base research only on convenience sampling without replicating results or adding in an additional probability-based sampling method, your research findings might lack credibility within the wider research industry.

- Positivity bias: You may end up having a positivity bias if the people you recruit are too close to you personally and know you want certain results, while people from your workplace may want to please the researcher in general.

- Breaking down results into demographic data may be more difficult: This is because you may have done data collection on the same type of person, based on where you’ve sampled from (for example, if you’re in an elderly home, you’ll have more participants that are older). This might lead to under-representation or over-representation in some population subgroups.

Why is it important for businesses?

Given the advantages and disadvantages of using convenience sampling, why should you use it in business? Convenience sampling can help you achieve business goals that otherwise might not be possible.

Businesses can use this sampling technique when thinking about how to make changes to their brand or products. For example, if one company is interested in seeing how their new toy performs with children in general, they might go to the mall and approach parents with children to ask for interaction with the toy.

It’s a great way to check-in with the target market that their perception of your brand or company is strong. This can be achieved by asking questions like ‘have you heard of x brand?’ and ‘what do you think about when you think of x product?’

Sometimes, businesses can’t appeal to the whole population as they can’t contact the whole population or the whole sample isn’t available to them. It would also be impractical to survey the whole population to find a truly random representation of the target audience’s views.

In these cases, research needs to happen, and ‘getting who you can’ to review and assess the company’s services can be critical to making decisions on product design, market research, or entering into a new market. It is also useful when looking at concept testing or feature prioritisation.

Another use for convenience sampling is to highlight to the company when there are serious problems. When you speak to people about your brand, they may come up with concerns that give you great insight into the improvements needed.

Some situations, convenience sampling is the only possible option

3 business use case examples of convenience sampling

Getting the public response to a brand event (e.g. the launch to a new gaming product)

A researcher could stand in front of a gaming store or enter an online games forum, following the release of their brand’s new game. They could ask customers that exit or enter the stores, or people in the forum, to participate in a short survey for their reaction to the game. They could include in the survey a question asking if the participant had bought the game, liked the game, disliked the game, and what their reaction was to particular features (like the visuals, storyline, pace, etc.)

Asking for feedback from employees on what a company should do (e.g. to revamp the company dining room)

By asking workers who use the company dining room, researchers can collect data on their thoughts about the current dining room and the ideas for the future room. This could help identify things that could help with the user experience from the intended users of the room.

You could send out an online link to the survey in a company newsletter, ensuring that those people who use the dining room will see it and respond to the survey (as there is an incentive to have a nicer dining room if they participate). Alternatively, a researcher could stand in the dining room during lunchtime to request for participants in person.

Understanding whether it’s worth spending money on full-scale research by running a pilot

Your managers might want you to test out a theory or gain initial primary data from people, to give them a ‘sense’ of what the target market wants and how they should react. This can give great results that are quick and easy to translate into results, giving clear information that acts as data to create a data-driven decision.

If the pilot is successful, it’s likely that the research team will get the budget and backing to conduct a full-scale research project.

How to use convenience sampling without skewing data collection

Getting the best data from participants is a primary concern for most researchers, and survey research suggests a number of ways to prevent data corruption:

- If you’re looking for deeper reasons why a participant responded in the way they did, it’s best to expand your research to include both qualitative and quantitative questions. This gives you a richer understanding of the views and opinions of your target market.

- To gain external validation and improve credibility, researchers may choose to use other sampling methods, like a probability-based sampling technique to supplement the research of convenience sampling. This means that you can get instant responses through convenience sampling, but you gain a representative pool of people that also provide their views. While this may take longer, and requires greater knowledge of your population, it can give you more valid results and avoid sampling bias.

- Use pre-made panels from external companies that help you find your sample without doing the hard work of administering and dividing the demographic information into sub-sections.

- If you’re concerned about the range of responses from your convenience sampling, opt to do a greater number in your convenience sample, so that you can get a range of opinions and thoughts (resembling a large population sample). This is likely to give you a stronger sense of trends when you come to analyse the data.

- Do multiple samples so that you can test out the same questions on different sets of people that are easily accessible and willing to participate. This means that you can draw from a larger data set, and see reactions over time as well.

How to analyse convenience sampling data

You’ve completed the research and now you have some data to analyse. What can you do with a convenience sample data-set?

You can do quite a lot. You can summarise the total results as a whole. You can review the qualitative data answers and form these into trend analysis graphs. You can also look for similar levels of positive or negative sentiment in qualitative answers. You may find that common phrases come up, which are worth noting as potential issues or highlights.

Where there is a larger sample that was used, you can cross-validate the first half of the data with the second half of the data. This means that you can compare the findings of each, to see if there are clear similarities or differences, providing another way to focus on what your results are telling you.

Since convenience sampling is hard to replicate with the people, at the same time, in the same circumstances, you can only repeat the research for more insights that add to your original. Therefore, your results should have a section on methodology, explaining that the results were obtained based on convenience sampling in certain conditions. Readers can then see that the analysis you’ve provided is based on that context, preventing misleading conclusions.

How Qualtrics software enhances and simplifies convenience sampling

Convenience sampling is simple and easy for people to do, and one of the steps is to create a survey. While this could be on paper, an online survey provides more flexibility for sharing more widely, and the results can be collected onto an insights platform in real-time.

It would be simple to use any survey software, but Qualtrics has thought about what a research team genuinely needs from the start to the finish of research like convenience sampling. Some things that Qualtrics can provide that speeds up and simplify convenience sampling are:

- Panel Management and our research services: When you are looking for a sample through the convenience sampling technique or otherwise, we have readily available and vetted participants that can present a random selection.

Similarly, if time is a concern, having a panel of participants ready to go at a moment’s notice is a great resource to have. With research services, you also choose how much or how little support you need. You get the right respondents for every project — even if you want to run a quick pilot.

- Building the survey quickly and easily: Pre-made templates and questions can be put into a survey quickly with drag-and-drop functionality. Our extensive support library and resources mean that anyone can pick this up and do it with ease. What’s better is that your survey is mobile-friendly, customisable for your brand, and easy to deliver in different formats.

- Analysis done for you: What’s more speedy than having intelligent analysis and automated actions that help you get your results fast and presented in easy to share reports built into the CoreXM framework. You can turn the data you get into insights in this centralised platform, which becomes the one single source of operations to run all your research from. This includes seeing your response rates and easily boosting participation using follow-up emails directly from the platform.

- Repetition and merge this with other research results: For example, want to repeat your convenience sample survey or run multiple parallel pilot studies – there are easy survey actions for that! Send the same survey to other people, and simply compare the results. Combine your data sets into one report, and see the information come to life with a few clicks.

Qualtrics CoreXM is our solution to support you to apply any sampling methodology to deliver the results you need and at scale. Best of all, it’s much faster and easier to use, less costly and you’re in control.

Improve the quality and volume of quality research you make, without the need to outsource or do training. If you’re looking for convenience and using convenience sampling methods, try Qualtrics CoreXM to give you the survey platform, participant panels, analytical insights, repetition, speed, and ability to deliver your work without a great deal of effort. Not only perfect for helping you with convenience sampling, but also more advanced analysis and all your research needs.

Discover how you can transform your market research